In a nutshell:

- Fintech firms are investing in AI to enhance effectivity and improve buyer experiences.

- AI use instances in fintech embody predicting buyer churn, robo-advisors, chatbots, fraud detection, credit score scoring, monetary forecasting, and GenAI.

- AI helps fintechs streamline inside processes, construct higher merchandise, and enhance ROI.

- Pecan’s Predictive GenAI platform simplifies constructing machine studying fashions for fintech firms.

- Fintech firms utilizing AI are higher positioned to face out in a crowded market and ship customized companies to clients.

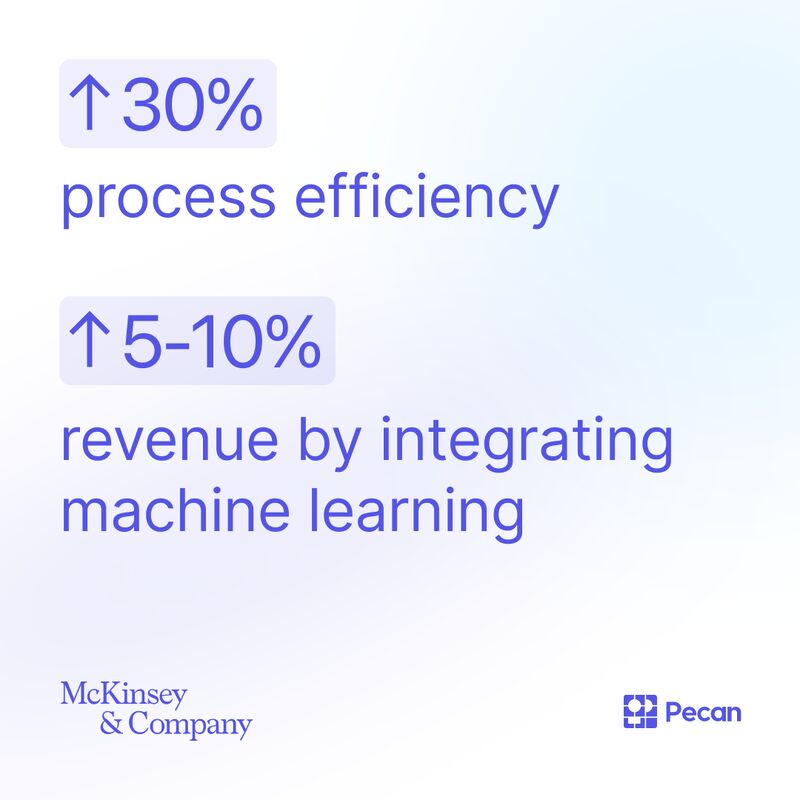

In accordance with McKinsey analysis, greater than 20% of all organizations’ digital budgets go towards AI-related tech, and people who make vital AI investments expertise a gross sales ROI uplift of between 10% and 20%.

Sadly for fintechs, whereas the trade is anticipated to develop 3 times quicker than conventional banking firms, funding has leveled out. To succeed, fintechs should display their worth to traders and clients.

As fintech leaders prioritize sources and attempt to stand out in an excessively crowded market, AI turns into a differentiator. On this weblog, we share the highest methods fintechs are utilizing AI to easy inside processes, construct higher merchandise, and enhance ROI.

Picture by Jakub Żerdzicki on Unsplash

The advantages of AI in fintech

Excellent news: virtually half of all shoppers need to add extra fintech options to their each day lives. However additionally they crave better personalization and fast customer support responses — ultimate use instances for AI.

AI’s many advantages embody:

- Extra personalization. From in-app experiences to customer support and related cross-sell and upsell adverts, data-driven insights from AI inform how manufacturers have interaction with people and will help make every buyer really feel seen.

- Improved effectivity. With AI, fintechs can do extra quicker, which might cut back overhead whereas maintaining prices decrease for shoppers. Win-win.

- Enhanced accuracy. Fewer costly errors in inside processes lead to higher regulatory compliance and higher-performing merchandise (to not point out extra correct forecasts and budgets).

- Higher safety. AI can detect anomalies, unhealthy knowledge, and fraudulent exercise earlier than they’ll do vital hurt.

- Faster time to market. AI will help all through each stage within the product lifecycle, from vetting new concepts to predicting market efficiency and even creating these new merchandise at lightspeed.

Why fintech is primed for AI

Whereas virtually all industries can put AI to good use, fintech firms are particularly well-suited for various AI use instances. Simply take into account these traits of fintechs:

- Giant and ever-growing volumes of information, together with monetary knowledge, internet habits, demographic knowledge, and purchasing insights

- Established trade area experience, together with specialists within the banking, authorized, and know-how spheres

- A number of duties of accelerating complexity that received’t match conventional rule-based automation and may change shortly over time

- Lengthy-term tasks with big potential to create ROI

- Clients with an extended lifecycle as they navigate varied seasons (parenthood, mortgage, retirement) with surging expectations for personalization

Admittedly, fintech startups can require extra time to get off the bottom due — partially — to banking and monetary rules. Nevertheless, as soon as a challenge will get cleared for the general public, it’s usually been vetted to qualify it for probably the most useful AI use instances. A stable fintech product could have performed a lot of the legwork to carry AI on board with out an excessive amount of extra oversight.

Picture by rupixen on Unsplash

High 7 use instances for AI in fintech

From higher inside processes to delighting clients, these seven use instances display why fintech is primed for AI.

1. Predicting buyer churn for monetary apps

Historic buyer churn charges could also be calculated with a easy equation, however understanding the continuing challenges is kind of advanced. Predictive AI stands within the hole between what we predict causes buyer churn and what’s most certainly to be the trigger, utilizing occasions like logins and search habits as clues.

Predictive AI also can rating how doubtless a buyer is to churn so you’ll be able to treatment a rocky relationship properly earlier than the client leaves. As an alternative of watching clients go, you’ll be able to goal them proactively with customized campaigns and extra genuine assist to show them round earlier than they’re gone without end.

2. Robo-advisors

AI buying and selling assistants have moved traders out of stuffy buying and selling flooring and into the true world, the place they’ll make high-stakes trades with extra certainty — and from the comfort of a cell app. Because the first robo-advisors hit the market in 2008, merchants have entrusted billions of property to this time-saving tech. (International traders will put $1.8 trillion into these instruments in 2024 alone.)

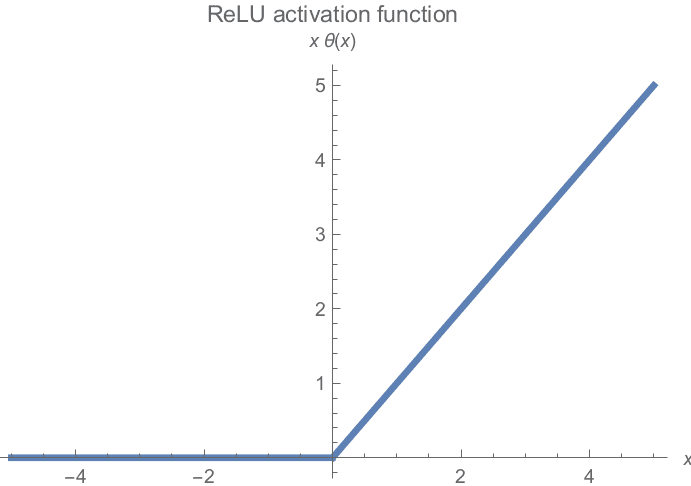

This know-how doesn’t simply cut back the possibility of human error. Robo-advising know-how provides merchants and traders entry to huge quantities of buying and selling knowledge that might by no means be adopted manually. AI’s statistical fashions have additionally change into fairly superior. With the addition of machine studying (ML), previous buying and selling wins change into the coaching knowledge to foretell future outcomes.

3. Customer support chatbots

If given the selection between ready quarter-hour for a human buyer agent or getting a chatbot, 60% of consumers would select the chatbot. Time issues. As a result of individuals care deeply about how their wealth and property are dealt with, fintech is one trade by which clients could have many questions. Chatbots will help alleviate customer support congestion and supply quicker insights than a 1-1 customer support agent.

4. Fraud detection and prevention

Creating algorithms to comb by means of huge quantities of economic knowledge is not a brand new pattern. The IRS and different authorities entities have been doing this for years, and it’s made a major influence in decreasing fraud.

Non-public firms have the chance (and responsibility) to do one thing related, particularly as digital cash scams and faux insurance coverage claims proceed to rise. As a result of it’s unimaginable to manually assessment each transaction that comes by means of a financial institution or cash switch service, AI could be the excellent answer to a fraud epidemic. It could actually immediately acknowledge primary spending patterns for a person buyer and examine these to real-time transaction knowledge, then flag any inconsistencies for an worker to assessment. AI additionally by no means sleeps, which generally is a actual profit for combating international crimes in a 24/7 digital setting.

Picture by Avery Evans on Unsplash

5. Credit score scoring and danger evaluation/mortgage underwriting

Getting authorized for a bank card or automotive mortgage was once dictated by a credit score report, earnings, and some different normal items of knowledge. Whereas this qualifies the most certainly shoppers to repay a mortgage, it shuts out some debtors who would doubtless be capable of pay, leaving enterprise on the desk.

New AI-based credit score scoring fashions transcend what banks see on a static software, together with the credit score rating on the precise second of the credit score pull. These fashions take a look at historic data from a wide range of private and non-private sources and may predict with higher accuracy if somebody is really a credit score danger. This opens the door for extra debtors who’ve been historically ignored, and it retains banks from lending cash to candidates who look good on paper however are extremely more likely to default.

6. Monetary forecasting

AI reduces the overwhelm concerned with cash-flow forecasting and helps monetary professionals concentrate on the best developments on the proper time. It additionally flags unhealthy knowledge that may derail predictive accuracy. At the moment’s AI forecasts use the corporate’s personal person knowledge in addition to knowledge from third-party sources. In truth, every part from the climate to commodity values, international political forces, and historic buyer developments will help inform higher monetary predictions and cut back danger over time, all with the assistance of AI.

7. Construct predictive fashions quicker with GenAI

Of these firms utilizing GenAI, 82% achieve this as a result of they assume it’ll “considerably change or rework” their industries. With fintechs, massive language fashions (LLMs) like ChatGPT4 assist not solely ideate however velocity up how they construct new services.

GenAI is extremely prized as a coding assistant and will help your knowledge staff fine-tune current machine-learning fashions and construct new ones. With out the most recent in GenAI instruments, knowledge analysts should spend days or perhaps weeks researching earlier than constructing a brand new mannequin from scratch. Predictive GenAI can truly write code to your fashions in minutes; it simply must be prompted.

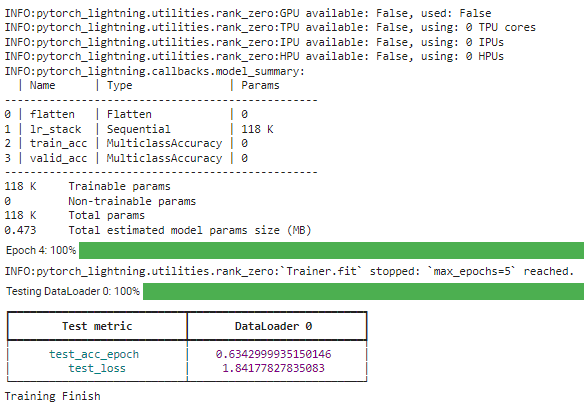

Picture by Kevin Ku on Unsplash

Construct fashions in minutes with Pecan

You doubtless have already got the info wanted to unravel your largest issues at the moment — whether or not it’s to struggle fraud, scrutinize creditworthiness, or cut back buyer churn. Now, it’s worthwhile to have AI ingest and course of it correctly so you’ll be able to seize these important insights and act on that knowledge.

With low-code predictive analytics platforms like Pecan, knowledge professionals and enterprise customers can chat with a GenAI copilot to isolate a enterprise drawback, choose the best mannequin, and generate a SQL-based mannequin in minutes — all in an intuitive chat-based interface.

Pecan’s Predictive GenAI platform makes constructing machine studying fashions as straightforward as typing. No knowledge science or engineering diploma required. You simply want to have the ability to ask the best questions.

With the fintech subject turning into more and more crowded, those that use AI and GenAI will stand out to their clients, ship better personalization, and optimize their inside processes.

Pecan helps you uncover correct predictions about your enterprise so you may make smarter investments and develop your organization properly into the longer term.

Ask us how. Join a demo at the moment.